DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS. I MAY RECEIVE A COMMISSION FOR ANY CLICKING AND PURCHASE MADE THROUGH ANY LINK WITHIN THIS PAGE. PLEASE READ MY DISCLOSURE FOR MORE INFO

Welcome to our September Financial Progress Report!

We started this journey of recording our progress towards Financial Freedom in February 2018. It was important for us to find a way to document our journey and help hold ourselves accountable to our goals. Our monthly Financial Progress Reports were created from this moment. We have been amazed to see the progress that can be made by finding different ways to decrease our debt, make more money and save more.

Each month we review and update our financial data once we have received all our financial statements. Our financial progress reports are then created from the financial data of the previous month. This typically falls within the middle of the month as some bills fall on the 1st of the month and many others towards the end of the month.

In our Financial Progress reports, you can expect to see an outline of our debt, savings, investments, expenses, and income progress. Also, we will include a small snippet of what we did or what we need to do to improve each area. As time goes on, you can expect these progress reports to evolve and improve as we learn more about taking control and cultivating our money.

Budget

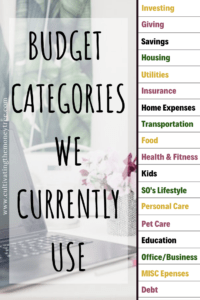

We currently use Dave Ramsey’s Everydollar website as our main budgeting tool. Below you will be able to see the main categories that we have chosen to represent where we spend our money. A couple of months ago we added investing as a new main budget category. We have found it important for us to continue to analyze and adjust our budget categories as we develop new financial goals.

Now, what you may not see in this graphic are all the other subcategories that feed into the main categories. For example, our Insurance category is broken into our auto, home and life insurance premiums. This gives us the ability to see what we spend on each insurance policy and all our insurance policies collectively. By taking a few extra tracking steps, we are providing ourselves with knowledgeable information. Especially when it comes time to shop around for better policies. How do you create your budget categories? Have they served you well?

Tacking It A Step Further

In our June 2018 Financial Progress Report, we provided a small snippet of the methods behind our monthly budgeting and tracking. Each month we review our previous month’s expenses and evaluate where we need to adjust the amount we budget for. To keep track of our monthly bills so that they are inputted in our budget correctly, we keep a list of all our fixed bills, their amounts, and their due dates. We make sure that our bills are listed in order from the earliest due date to the last due date in the month. Then, as we pay each bill, we will check off by dating each item paid.

Our earned income pay periods vary throughout the year. My employer follows a bi-weekly pay schedule consistently throughout the year. However, my SO’s pay schedule transitions from bi-weekly to weekly and then back to bi-weekly. Due to these transitions, it has been important for us to stay organized and continue keeping track of every bill and expense that needs to be paid between pay periods. Doing this ensures that we are paying bills on time or sooner which also saves us money by avoiding late fees and unnecessary interest.

To keep track of every bill in between pay periods, we break our bills down into a weekly duelist. Since our pay schedules vary, this has helped us tremendously in our ability to manage our money. Keeping track of our spending on a weekly, monthly and yearly basis gives us so much knowledge and insight into our spending habits and staying accountable to our money goals.

Now that you have some background knowledge on how we budget, let’s take a look at the overall monthly progress made in July towards our goal of Financial Freedom!

Debt

August 2019 Total Debt: $140,315.90

September 2019 Total Debt: $139,928.47 (-$387.43)

Credit Card Debt: $13,909.38 (-$153.51)

Auto Loans: $15,316.44 (-$233.92)

Student Loans: $110,936.57 (+$0.00)

Our debt repayment progress started heading back in the right direction in August and continued through September. While we are still not contributing as much as we were earlier in the year, we still managed to decrease our debt and maintain all our other bills. When we go through a season of unexpected expenses or setbacks, we are reminded to continue working on transforming our money mindset so that we could manage these difficult seasons with grace.

Finding the best debt repayment plan

Over time we have learned how to alter our methods and find solutions for our money woes. Every few months we like to evaluate our current debt repayment strategy. When it comes time for us to review our current debt repayment strategy we head straight over to undebt.it.

We love using their FREE debt snowball calculator to track our journey! You only need to have a list of each of your debts, their current total balance, your monthly minimum payment, and your current interest rate. After you provide that information, the calculator will do the rest. You can determine which method will get you closer to debt freedom faster. It is hard to say where we would be on our finance journey if we had not stumbled upon undebt.it. They have helped us gain more focus and clarity when it comes to our debt-free journey.

Overall, this month may have seemed unsuccessful as we added more debt to our balances. However, we choose to look at this as a temporary setback and that our decision making and mindset have changed so drastically. We are still on course to have our credit card debt paid off within the next 15 months and perhaps sooner. Have you ever had to add more debt back to your total balance during your debt repayment journey? Share your story and how it impacted you.

Savings

August 2019 Total Savings: $11,637.42

September 2019 Total Savings: $11,763.00 (+$125.58)

Emergency Fund: $5711.17 (-$296.74)

Sinking Funds: $1016.69 (+$120.50)

Her Retirement Fund: $5035.34 (+$302.02)

Again this month, we had to utilize our emergency fund. However, I must say that it was used to cover dental expenses. These expenses were planned and accounted for but we had some unexpected expenses for our daughter’s extracurricular activities. It is important for us to support our children’s hobbies and interests. Our daughter understands that she can not do every activity she is interested in but we try to plan and budget for those that are important to her.

Even with these small monetary losses our other sinking funds and my retirement fund continued to see positive growth. Had we not been contributing to savings while also paying back debt, these unexpected occurrences could have had a negative impact on our monthly bill payments. We are so thankful that over time the desire to be truly debt-free and financially independent helped guide us to learn more and change our money habits.

Currently, our emergency fund still includes our sinking funds. While we have narrowed down the different sinking funds we need for the next year, we are still not quite ready to get them all separated into their own accounts yet. The sinking funds listed above include our online savings account and additional smaller savings accounts at local banks.

Gaining Control of Our Savings Accounts

In May 2019, we moved forward in opening our first high-interest online savings account. That month we focused more on getting the account established and making a couple of small deposits. The process has been seamless and effortless as we have set up automatic transfers since then. We have already seen better interest earnings than any of our other savings accounts with just such a smaller balance.

Our plan is to move forward with setting up our various sinking funds and creating automatic savings goals. We are excited to continue to see growth in our savings contributions. Finally deciding to set up automatic transfers to deposit into our savings accounts has been the best decisions so far. How did setting up automatic contributions impact you!

We are just so thankful for the opportunities that we have been given to develop better money habits. Our development efforts have started to help us make smarter financial decisions. We look forward to continuing to find ways to save more money and grow our savings passively.

Investments

August 2019 Total Investments: $110.62

September 2019 Total Investments: $122.26 (+$11.64)

Stash: $80.70 (+$6.46)

Acorns: $41.56 (+$5.18)

A few months ago I decided to start learning more about investments. Since I consider myself a hands-on learner, utilizing micro-investing apps seemed like the best fit. They both have built-in resources and tips for learning more about the investment world. This has been very helpful for someone like me who does not have any previous experience or knowledge about investing practices.

As much as I was taught about personal finances growing up, I wasn’t taught much on investing beyond contributing to employer-sponsored retirement accounts. Additionally, I wasn’t able to take advantage of the economics classes due to other required class schedules. So due to my lack of experience and knowledge in investing, I wanted a low-risk but educational way to invest my money.

After some research, I found that there were many investment apps available. However, the Stash app and the Acorns app gained my attention the most. They both provided a simple and user-friendly process for investing and buying stocks and mutual funds. The two apps share many of the same features like setting up automatic contributions or enrolling in round-ups. However, they both have slightly different features that make it hard to choose just one of them. Why choose just one, though? Why not contribute to both? As you can see, I decided to contribute to both!

Expenses

Total Expenses: Largest Spending Categories

Debt: 18% (+4%)

Food: 17% (-0%)

Housing & Utilities: 14% (+1%) 14%

Many of our expenses remained under 10% for the month of September. We saw a slight increase in our debt and our housing and utility expenses. Our largest spending categories have remained consistent all year as our top three monthly expenses. We tend to only see in these categories change when we have less frequent large expenses come due which are now cash flowed instead of being charged to the credit cards.

Having the ability to cash flow many expenses lately has helped us realize how far we truly have come on already. This journey to financial has helped us grow in more areas than just our finances. We have seen an improvement in our time management, our outlook on life, and the other little habits we make every day towards a better life.

Some of the little habits we do weekly is tracking our expenses manually. This process has humbled us and forces us to be self-reflective on how and where we are spending our money. We have expressed the desire to automate the process of keeping track of our spending to gain more energy and time. However, we wonder if by automating this process we will lose valuable insight on how to improve our spending habits. What is your favorite way to track your spending habits?

The form you have selected does not exist.

Income

August 2019 Total Extra Income: $3.05

September 2019 Total Extra Income: $59.13 (+$56.08)

We saw some positive changes in our September extra income. Our schedules have become a bit consistent between work and school. This specifically allowed me the ability to schedule some mystery shops and receive payment from those. I love using BestMark when their mystery shop opportunities mesh well with my schedule. Since I started mystery shopping, I have been able to earn over $100 by providing feedback to companies on their operations. In addition to the extra income earned from BestMark, we were able to increase our Ibotta cashback earnings in September.

Ibotta has always been consistent in allowing us to earn extra income each month. We love that our family receives cash back on our everyday grocery shopping trips. Since we started using Ibotta over a year ago we have earned just over $250. Are you interested in learning how you can maximize your Ibotta’s earning potential? If you decide to start taking advantage of cashback through Ibotta, we invite you to join our team here. By joining our team and redeeming one offer within the first month, you will earn $10.00!

Ibotta: $20.50

Mystery Shopping: $38.00

User testing: $0.00

Online Surveys: $0.07

Quora: $0.58

Misc: $0.00

Monthly Goals

Every year we set out to reach certain milestones. We learned last year that we must start setting monthly goals that build into our long term goals if we want to see success.

Every month, we try to break down the 5 biggest areas that are priorities for us for the year into smaller and measurable goals. Many of these areas for the 2019 year are financial, personal development, health & fitness, family and career. Each month we intend to share our results of the goals that we set for additional accountability. Below after we post the results of our past month’s goals, you can expect to read a snippet of our successes and our setbacks during that month.

In September we were able to make progress towards the majority of our goals. We managed to decrease our credit card debt and declutter a couple of rooms. I joined a crockpot challenge group that made meal planning and grocery shopping simple. We spent more money on dining in then we did on dining out. However, since we were low on many food staples like seasonings, sauces, and oils we did see a slight increase in our food expenses. I continued to spend much of my leftover free time researching information for articles, creating content and working through some courses.

We have really enjoyed using this process to commit and stay accountable to our monthly goals. This process helps us stay on track and helps to break our large goals down into smaller achievable ones. We look forward to continuing to do this each month. Check out our Instagram feed to learn more about our goal focus for August!

Financial Progress Report Recap

While we still went through changes and adjustments in September we still managed to end the month on a positive side. In the next couple of months, we will be focusing on preparing for my significant other’s lay off. This will have a great impact on our finances, However, we feel better prepared this year than any previous years.

Overall, our actions have been decreasing our credit card debt and improve our savings balances. We have noticed that we are gaining more control of our spending as our budget categories align with our goals. This month has provided us with the need for reflection and evaluation as we push forward with our next goals. Month to month we are continuously learning to new ways to adapt our finances to our life’s needs. Perhaps we are truly making progress in the right direction.

Previous Financial Progress Reports:

2019

- August 2019 Financial Progress Report

- July 2019 Financial Progress Report

- June 2019 Financial Progress Report

- May 2019 Financial Progress Report

- April 2019 Financial Progress Report

- March 2019 Financial Progress Report

- February 2019 Financial Progress Report

- January 2019 Financial Progress Report

2018

- December 2018 Financial Progress Report

- November 2018 Financial Progress Report

- October 2018 Financial Progress Report

- September 2018 Financial Progress Report

- August 2018 Financial Progress Report

- July 2018 Financial Progress Report

- June 2018 Financial Progress Report

- May 2018 Financial Progress Report

- April 2018 Financial Progress Report

With every new month that goes by we are so thankful for the support that we have gained from the debt-free community. Additionally, we have improved our accountability by reporting on our financial progress. This has really allowed us to remain determined and confident in our abilities to keep meeting goals. As we move into October, we plan to have very similar goals. While they are similar these goals will still help us make progress towards our journey to Financial Freedom.

Do you set various monthly personal financial goals? Are these goals aligned with your long-term financial goals? What is your biggest struggle in setting and meeting financial goals? Share Below!