DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS. I MAY RECEIVE A COMMISSION FOR ANY CLICKING AND PURCHASE MADE THROUGH ANY LINK WITHIN THIS PAGE. PLEASE READ MY DISCLOSURE FOR MORE INFO

Welcome to our monthly Financial Progress report series. We started this journey of recording our progress towards Financial Freedom in February 2018. It was important for us to find a way to document our journey and hold ourselves accountable for our goals. Our Financial Progress Reports were created from this moment. We have been amazed to see the progress that can be made by finding different ways to decrease our debt, make more money and save more.

Each month once we receive all our financial statements we then review and update our financial data. From this financial data, we then compose our financial progress report for the previous month. This typically falls within the middle of the month as some bills fall on the 1st of the month and many others towards the last days of the month.

In our Financial Progress reports, you can expect to see an outline of our debt, savings, expenses, and income. Also, we will include a small snippet of what we did or what we need to do to improve each area. As time goes on, you can expect these progress reports to evolve and improve as we learn more about taking control and cultivating our money.

Budget

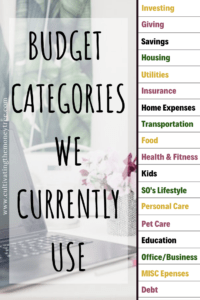

We currently use Dave Ramsey’s Everydollar website as our main budgeting tool. Below you will be able to see the main categories that we have broken our budget up into. There are additional sub-categories within these main categories. The last time we updated our main categories was in April of 2018. Since then these categories have served us well in the ability to see trends in our spending habits. Last month, we decided that it was time to analyze and adjust our budget categories as our journey to Financial Freedom has developed. The biggest change is that we added investing as a new budget category. When was the last time that you reviewed your budget categories?

In our June 2018 Financial Progress Report, we provided a small snippet of the methods behind our monthly budgeting and tracking. Each month we review our previous month’s expenses and evaluate where we need to adjust the amount we budget for. To keep track of our monthly bills so that they are inputted in our budget correctly, we keep a list of all our fixed bills, their amounts, and their due dates. We make sure that our bills are listed in order from the earliest due date to the last due date in the month. Then, as we pay each bill, we will check off by dating each item paid.

Right now. mine and my SO’s earned income is on a bi-weekly pay period. This provides us the need to stay organized and continue keeping track of every bill and expense that needs to be paid between pay periods. Doing this ensures that we are paying bills on time or sooner which also saves us money by avoiding late fees and unnecessary interest.

To keep track of every bill in between pay periods, we make another list that breaks down our bills by their due dates into a weekly duelist. Even though my SO and I are both paid bi-weekly, our employers are on different pay cycles. What this means is that each week we are getting a direct deposit from either company. This does help us tremendously in how efficiently we are able to manage our money. Keeping track of our spending on a weekly, monthly and yearly basis gives us so much knowledge and insight into our spending habits and staying accountable to our money goals.

Now that you have some background knowledge on how we budget, let’s take look at our overall month progress towards Financial Freedom!

Debt

April 2019 Total Debt: $124,950.46

May 2019 Total Debt: $123,962.51

Credit Card Debt: $14,216.19

Student Loans: $109,746.32

Last month we had hoped to decrease our debt by $800, but we ended up being just over 40% shy of that goal. In May, we were able to make this a reality due to us receiving the money we were expecting in April. We started the month of May with $15,204.14 in credit card debt. By the end of May, we surpassed our goal and paid off a total of $987.95. Just like we had hoped our total credit card is in the 14Ks!

Guys, this is still a big deal to us. We started our journey with over 20K in credit card debt plus a personal home loan and car loan. I am still amazed at how far we have come since we started getting serious and holding ourselves accountable in our financial goals. While there is a long journey ahead of us still, these reports help remind us what we can achieve when we transform our money mindset.

This journey to financial freedom has taught us how to alter our methods and find solutions for our money woes. Every few months we like to evaluate our current debt repayment strategy. We are currently still finding results by utilizing the debt snowball method. However, as we approach our credit cards with similar balances it is important to us that we continue to evaluate our debt repayment method. We are total believers of the debt snowball method, but we also understand there are different methods available that could potentially save us time and money.

When it comes time for us to review our current debt repayment strategy we head straight over to undebt.it. We love using their FREE debt snowball calculator to track our journey! You only need to have a list of each of your debts, their current total balance, your monthly minimum payment, and your current interest rate. After you provide that information, the calculator will do the rest. You can determine which method will get you closer to debt freedom faster. It is hard to say where we would be on our finance journey if we had not stumbled upon undebt.it. They have helped us gain more focus and clarity when it comes to our debt free journey.

Needless to say, we are excited about the progress we are seeing in 2019 so far. We are finding ourselves making better decisions and getting creative on how to pay down our debt faster. Based on our calculations we will be credit card debt free within the next 20 months. After we have successfully paid off all consumer debt, we will start aggressively tackling my student loans. When did you start feeling the momentum of your debt repayment journey?

Savings

April 2019 Total Savings: $9,360.97

May 2019 Total Savings: $9,960.30

Emergency Fund: $6,277.09

C’s Retirement Fund: $3,683.21

Our savings accounts are continuing to see steady growth. Not only are we contributing more each month to savings, but we are also earning more interest as well. We feel more secure by contributing to both debt and savings at this time. There was a time when we had very little savings and we contributed to as much debt as we could. However, unexpected expenses kept popping up that caused us to either charge it or deplete whatever little savings we had. We never seemed to make real progress in either debt repayment or savings growth.

Over time the desire to be truly debt free and financially independent helped guide us to learn more and change our money habits. This way we stopped using the credit cards and started saving for unexpected expenses because we all know life brings them.

Currently, our emergency fund includes our sinking funds as well. While we have narrowed down the different sinking funds we need for the next year, we are still not quite ready to get them all separated into their own accounts yet. However, in May we move forward in our first high-interest online savings account. This month we focused on getting the account established and making a couple of small deposits. We love how effortless the process has been. Additionally, we have already seen better interest earnings even with a small balance.

While we are still researching different savings options for our long term savings goals, we are ready to start setting up our various sinking funds. Additionally, we have been discussing how to automate our savings more. We have considered the best methods for us at this time is to set up automatic transfers to deposit into our sinking fund accounts. We would love to hear more about how you automate your savings!

Overall, our savings contributions are continuing to grow. We are thankful for the opportunities that we have been given to develop better money habits. Our development efforts have started to help us make smarter financial decisions. We look forward to discovering additional small ways to save more money and grow our savings passively.

Expenses

Total Expenses: Largest Spending Categories

Debt: 17% (+1%)

Food: 13% (-5%)

Kids 8% (+2%)

Health & Fitness: 7% (-11%)

Last month, we discussed a money milestone for us in our spending habits. We successfully planned, budgeted and cash flowed multiple health services. Had we never started this journey to financial freedom, we would have charged these expenses to some credit card. We would then plan on just paying minimum payments for years to come!

May was another month in which we saw our four largest spending categories shift slightly. Our food spending went down and we were able to increase our debt snowball payment by 1%. Additionally, we managed to cash flow more medical services and our daughters summer camp enrollment fees!

It is moments like this that make me realize how far we really have come. This journey to financial freedom has helped us grow in more areas than just our finances. We have seen an improvement in our time management, our outlook on life, and the other little habits we make every day towards a better life.

Some of the little habits we do weekly is tracking our expenses manually. This process has humbled us and forces us to be self-reflective on how and where we are spending our money. We have expressed the desire to automate the process of keeping track of our spending to gain more energy and time. However, we wonder if by automating this process we will lose valuable insight on how to improve our spending habits. What is your favorite way to track your spending habits?

The form you have selected does not exist.

Income

April 2019 Total Extra Income: $896.23

May 2019 Total Extra Income: $39.75

In May we were able to get accustomed to our new schedules as both my significant other(SO) and I both work full-time again. returned back to work full-time in April, Again, while we put little focus into earning extra income this month we still managed to bring in some income and meet goals in other areas of our lives. After reviewing our extra income earnings, we were reminded of how effortless Ibotta can be during our busy months.

Ibotta has always been consistent in allowing us to earn extra income each month. We love that our family receives cash back on our everyday grocery shopping trips. Since we started using Ibotta over a year ago we have earned just over $250. Are you interested in learning how you can maximize your Ibotta’s earning potential? If you decide to start taking advantage of cash back through Ibotta, we invite you to join our team here. By joining our team and redeeming one offer within the first month, you will earn $10.00!

Ibotta: $19.05

Mystery Shopping: $0.00

User testing: $0.09

Online Surveys: $18.64

Quora: $.61

Misc: $20.00

Monthly Goals

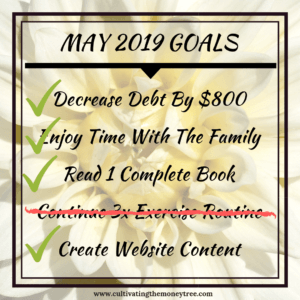

Every year we set out to reach certain milestones. We learned last year that we must start setting monthly goals that build into our long term goals if we want to see success.

Every month, we try to break down the 5 biggest areas that are priorities for us for the year into smaller and measurable goals. Many of these areas for the 2019 year are financial, personal development, health & fitness, family and career. Each month we intend to share our results of the goals that we set for additional accountability. Below after we post the results of our past month’s goals, you can expect to read a snippet of our successes and our setbacks during that month.

May focused on very similar areas as our April goals. We planned to decrease our debt, spending time as a family, read a whole book, exercise regularly and create content for my online business. As you may notice from our results image above, we successfully completed 4 of our 5 original goals. I am proud of the progress I am making towards my monthly goals. Even though, I mainly set and work to achieve these goals personally each month. I truly believe that they not only help me reach my personal goals but they also help me develop progress to our long-term goals.

We have really enjoyed using this process to commit and stay accountable to our monthly goals. This process helps us stay on track and helps to break our large goals down into smaller achievable ones. We look forward to continuing to do this each month. Check out our Instagram feed if you’re interested to know where our focus is going in June!

Recap

May was a great month of true progress and growth for me and us. Our hard work is becoming more apparent as our total debt continues to decrease and our total savings increases. Additionally, we are gaining more control of our spending as our budget categories align with our goals. This month has kicked our motivation up a notch and pushing us to keep moving forward. Month to month we are continuously learning to new ways to adapt our finances to our life’s needs. Perhaps we are truly making progress in the right direction.

Previous Financial Progress Reports:

2019

- Monthly Financial Progress Report Series: April 2019

- March 2019 Financial Progress Report

- February 2019 Financial Progress Report

- January 2019 Financial Progress Report

2018

- December 2018 Financial Progress Report

- November 2018 Financial Progress Report

- October 2018 Financial Progress Report

- September 2018 Financial Progress Report

- August 2018 Financial Progress Report

- July 2018 Financial Progress Report

- June 2018 Financial Progress Report

- May 2018 Financial Progress Report

- April 2018 Financial Progress Report

With every new month that goes by we are so thankful for the support that we have gained from the debt-free community. Additionally, we have improved our accountability by reporting on our progress. This has really allowed us to remain determined and confident in our abilities to keep meeting goals. As we move into June, we plan to have very similar goals. While they are similar these goals will still help us make progress towards our journey to Financial Freedom.

Do you set monthly personal financial goals? Are these monthly goals aligned with your long-term financial goals? What is your biggest struggle in setting and meeting financial goals? Share Below!