DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS. I MAY RECEIVE A COMMISSION FOR ANY CLICKING AND PURCHASE MADE THROUGH ANY LINK WITHIN THIS PAGE. PLEASE READ MY DISCLOSURE FOR MORE INFO

Have you ever wished you could erase your mistakes or simply start over with a clean slate? We spent many years making poor financial mistakes and we wanted to fix them but how? We wanted a fresh start on our finances, a do-over as they say without having to file bankruptcy. After searching for financial fixes we discovered how the steps to goal setting could help us really cultivate our financial goals.

There were countless articles and resources available to help us with goal setting. In fact, the process of goal setting seemed a bit overpowering at times. Goal setting appeared to require a lot of time especially if you had multiple goals for each area of your life. We found that each goal focus area required different information and actions. Certainly, not every process we found could easily transfer between each goal. Regardless, we tried different processes for achieving goals. At some point we found ourselves overwhelmed and wondered if we had too many goals.

Something Had To Change!

Many times we would set out to achieve a goal only to give up a couple of months later. We repetitively saw this with our personal finance goals. We made finance goals like saving for a vacation or paying down debt each time we decided to set goals for the year. However, our results were minimal and after evaluating our process we realized our current process didn’t exist for our personal finance goals. This made us realize that we were hindering our ability to cultivate our finances. We were not in the right mindset to alter our daily habits so that they could be more aligned with our overall goals.

We decided to start finding a way to transform our mindset and follow a process that would help us actually achieve the goals we wanted for ourselves. After being introduced to different goal setting theories, we decided to use a collaboration of them. When we actually stay focused and follow the process we then began to see true progress towards our personal financial goals.

Each component of the process given below allowed us to gain the confidence and motivation needed to keep moving forward. This process may not work for everyone but I am sure a component or two of this process may help you in your journey. Are you ready to learn more about how to cultivate your finances through goal setting?

Cultivating Your Personal Finance Goals

Know Your Numbers

We are firm believers that before you can begin cultivating your finances, you must know your current financial numbers. This is a powerful process that may require you to dig into your current and past money decisions. I forewarn you that you may not like what you discover through this process. However, knowing where you currently stand with your financial health provides you with great tools when making future money decisions.

During this process of learning your numbers, you will want to gather the what, when, and how of your finances.

- Income – What are your income sources? When do you receive your income? How much is each of your income sources?

- Assets – What are your current assets? When did you acquire these assets? How much value do your assets hold?

- Expenses – What are your current expenses? When is each expense due? How much does each expense cost?

- Debt – What are your current debts? When are your debt payments due? How much is each debt?

Before moving on to the next step of cultivating your financial goals, ensure that you gathered all your necessary financial numbers. We encourage you to have your financial numbers in one easily located place to refer back to often. Knowing our numbers and having them easily accessible to us brought great ease to us during this journey. Additionally, as we reflected and updated our current numbers having them all listed in one place saved us a lot of valuable time.

Define Your Goals

Once you have a good understanding of what your numbers are, you can start deciding what you need to work on to cultivate your finances.

- Do you need to bring in more Income?

- Is there a need to pay down debts to help lower your liabilities?

- Do you need to start a budget or fine-tune your current budget?

- What about your assets, do you need to build those up so that they profit even while you are sleeping?

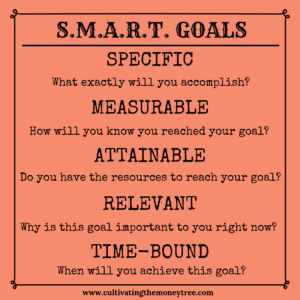

Wherever you are on this journey of cultivating your finances, it is important to pinpoint your key focus areas. Once you have narrowed down your key focus areas you can start the process of defining your goals. To assist in defining your goals you will want to work them through the S.M.A.R.T. goal process.

Have you heard of S.M.A.R.T. goals? S.M.A.R.T. goals stand for Specific, Measurable, Attainable, Relevant and Time-Bound. When you are defining your finances goals, you want to ensure that they meet each of these items. While this may make the process of setting goals a bit more involved than just claiming a resolution, it can be completely worth it. Not only does following this process help you think about your goals in more depth, it actually creates a roadmap. This roadmap can create an outline of the necessary steps and habits needed to assist you in reaching your goals.

Utilizing the S.M.A.R.T. goal process had a huge impact on how we moved forward in defining our goals. Before using this process our finance goals were very general such as paying off debt or saving for a vacation. We unknowingly lacked clarity and focus which held us back since our goals were not specific enough. Once we worked through this goal setting process our defined goals transformed. Instead of just simply stating we wanted to save up for a vacation, we now had a more specific goal. Having a specific goal meant we knew what we wanted and when such as saving $5,000 within the next 12 months for a vacation. We now had a well-defined goal thanks to the S.M.A.R.T. goal process.

Create Actionable Steps

Have you defined your goals and worked them through the S.M.A.R.T. goals process? As discussed earlier by working each goal through this process, a roadmap may have appeared. This roadmap can help you define the measurable, achievable and time-bound components of your specific goals. This process becomes more simple as you utilize the roadmap to start visualizing the steps that you will need to take to reach your goals. Think about what you need to do daily, weekly, or monthly that will allow you to step closer to your goals.

I was once introduced to a concept which has stuck with me ever since. The concept involved visualizing your ends results and then thinking of the steps in reverse order to determine the best course of action in achieving your desired. This process has really transformed the clarity I needed to determine the steps needed to reach my goals in the past.

If you worked through the steps of defining your S.M.A.R.T. goals, then you may already have some ideas on actionable steps that can be taken. Also understanding the needed frequency and level of intensity for each step can be beneficial as you work towards your goals.

Earlier we defined a specific goal of saving $5,000 in 12 months for an upcoming vacation. Since we get paid on a bi-weekly pay schedule we need to determine what to save each month or pay period. I can do this by taking my savings goal and dividing it by the 12 months. Taking $5,000 and dividing it by 12 calculates that I need to save $416.66 each month to reach my overall goal. This monthly amount can then be broken down even more based on what you need.

By taking the time to do these calculations I gained knowledgeable insight towards my goals. Having this insight allows me to ensure that my goals are measurable and attainable. So I discovered how many savings contributions I needed to make and how much each contribution needs to be. Now I can start developing the actions and resources needed to reach my financial goals within the set timeframe.

Utilize Resources

Do you know what resources you will need to achieve these goals? Will you have or can you gain access to these resources? Knowing your resources and how to utilize them can help you tremendously in reaching your goals. Resources can be anywhere from networking opportunities, family and friends, developmental tools, accountability partners, technology devices, or visual tools.

During our personal finance journey, we have used resources like listening to podcasts, following debt free communities, and subscribing to personal finance bloggers. Additionally, we have used various personal finance apps and software such as Mint. These resources have helped us save money, earn more money and change the way we handle our money. Most of these resources just needed our time and energy.

It is important to identify the resources that are relevant to your goals and devise a plan on how to utilize these resources. There are many types of resources available no matter the time of goals you have. For example, perhaps you have the motivation and determination needed to meet your goals but you struggle with accountability. Resources like local support groups, accountability partners or a life coach can be utilized and assist you in successfully attaining your goals.

Earlier we determined that we need to save $416.66 a month for 12 months to reach our $5,000 vacation savings goal. The plan is to utilize resources such as free apps that help you save money and complete task to earn more money. Everything saved and earned would then be contributed to this vacation savings fund.

Having the right resources is crucial when reaching for goals that may challenge you. While your resources can’t achieve your goals on their own, they can help ease the growing pains sometimes loom in pushing yourself. Also, keep in mind that we learned that utilizing resources can happen at any point during your goal setting process. Resources can help you with defining your goals, they can help with gathering your numbers and they can help you in creating your actionable steps.

Start Taking Action

Are your goals defined, actionable steps created and your resources ready to be utilized? Now start taking the necessary action to achieve your goals. This is where you start living and moving forward with the actionable steps you created earlier in the process.

If you are still unsure of what actionable steps you need to take, utilize your roadmap that was created by the S.M.A.R.T. goal process. This roadmap can help you evaluate the daily habits that are needed in order to get you moving towards your goals. This can be important as our daily habits form the foundation of action that we take towards our goals. The foundation of action that you develop will have an impact on your goals and their end results.

Many times consistent motivation and focus are required in developing a good foundation of daily actions. Developing good daily habits is a process within itself. This can also become more of a challenge when aligning them with your short and long term goals. Being able to take action towards your goals and continue to work through multiple processes can be time-consuming. Having time management skills is necessary when taking on additional task daily or weekly. Especially for busy individuals and families who already have full schedules. We have found the ability to follow our roadmap and save time by using planners and calendars to schedule each actionable step necessary to meet our goals. This also keeps us motivated and focused as it gives us a head start in tracking our progress as well.

Posts You May Like:

- How To Gain Control Of Your Spending

- 4 Budget Methods To Transform Your Money

- Gain More Control With These Savings Accounts

Track Your Progress

The ability to track your progress can help keep your S.M.A.R.T. goal measurable. Tracking your actions towards your goals can have many beneficial factors. Especially when it comes to your goals that will take months or years to achieve. We can trick ourselves into delaying actions because we think we have time. Tracking the progress of your actions towards your goals can ease the discouragement or lack of motivations that sometimes occurs.

There are many tools available that can assist anyone in tracking the progress of their goals. As mentioned before tracking your progress can be empowering, motivational, and rewarding. Many times it is a visual tool that allows you to see the tangible impact of your actions towards achieving your goals. We learned more about how to use visual tools for our financial goals on the hicharlie.com blog that made an impact.

Additionally, we love to utilize Microsoft Excel, printables, and budgeting software such as Mint to assist us in keeping track of our goal progress. The great thing about tracking your progress is that there are multiple ways that can work for about anyone. The truly important thing is that we are revisiting our goals to ensure that they are still relevant and achievable.

Setting aside time every month or so to track your progress and results can make certain that you are focused on your overall goals. Additionally, if you are not seeing the progress you thought you would this can assist with making changes. Being able to alter your plan through reflection can be crucial when the unexpected happens in life.

Reflect

Reflecting back on the steps you have taken towards your goal-setting process can be important, Taking the time to do this can provide great understanding and insight on your goal progress. This last step can even help you strategize and become more intentional on the steps needed for better progress. Reflecting back can help you avoid making the same mistakes or know where you can afford to take more risk.

- What part of this process worked?

- What didn’t seem to work?

- Did any steps in the process get skipped?

- Was your progress hindered by any shortcuts?

- What have you learned that you can apply to your future goals?

Through this process of reflection, we have been able to apply what we learned to our future experience. We have recognized a positive impact on our personal finance goals especially as we move towards debt freedom. If you take what you learn and grow from it, ultimately you should see yourself thriving.

Are you ready for a fresh start in your personal finances? Start cultivating your finances by using the S.M.A.R.T. goal process!

[…] 7 Steps To Cultivate Your Finances […]