DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS. I MAY RECEIVE A COMMISSION FOR ANY CLICKING AND PURCHASE MADE THROUGH ANY LINK WITHIN THIS PAGE. PLEASE READ MY DISCLOSURE FOR MORE INFO

Welcome to our monthly Financial Progress report series. We started recording the progress of our journey to Financial Freedom in February 2018. Our Financial Progress report has allowed us to document our journey and hold ourselves more accountable. We are amazed to see the progress that can be made by finding different ways to decrease our debt, make more money and save more.

Each month after we have received all our financial statements and updated all our financial data, we then compose our financial progress report for the previous month.

In our Financial Progress reports, you can expect to see an outline of our debt, savings, expenses, and income. Also, we will include a small snippet of what we did or what we need to do to improve each area. As time goes on, you can expect these progress reports to evolve and improve as we learn more about taking control and cultivating our money.

Budget

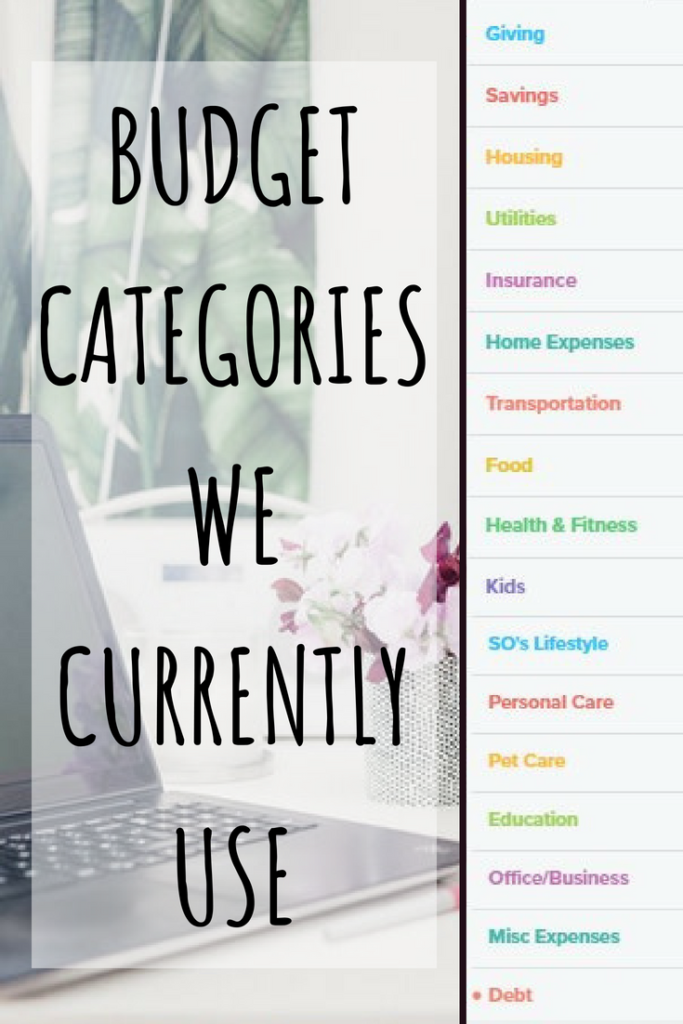

We have continued to use Dave Ramsey’s Everydollar website as our main budgeting tool. We have continued to use the categories that were broken down back in April. The trends in our spending habits have become more prominent as we have excelled at utilizing our new category system. A couple months ago we shared our new budget category system with our readers. This will always be included in each Financial Progress Report moving forward. Let us know how you have your budget categories set up!

Recently, we have been discussing changing the way we view our budget. We are considering fine-tuning our budget to mimic either the budget category percentages suggested by Dave Ramsey or through the 50/30/20 rule. Currently, we are learning more about these budget types and deciding which seems most feasible for our life at the moment. We would love to hear feedback from anyone who uses these budgeting techniques or others!

As we mentioned back in our June Report we are continuing to use manual methods that aid in tracking our budget and spending. Each month we use the art of list making. There are two different prominent lists that we use. One list is composed of all our bills with due dates and the second list breaks down our bills and their due dates by the week. This allows us to stay on track with our bills being paid on time and making sure that we use the correct paycheck for each billing period. These are just extra steps we take to provide checks and balances and give us peace of mind.

Now that we have provided you with an update on our budget, let’s take a look at our progress!

Debt

October Total Debt: $127,473.03

November Total Debt: $126,908.02

Credit Card Debt: $17161.70

Car Loan: $0.00

Student Loans: $109,746.32

November proved to be far more successful then October. As we continued to use the debt snowball method this past month, we were able to finally pay off our next smallest credit card balance. We are continuously moving forward to reaching the 16k threshold in credit card debt. This has been amazing progress for us as we have exceeded our expectations this past year in debt repayment.

While we have made exceptional progress, we expect the next couple of months to be slower with our debt repayment plan. This expectation is due to the upcoming Holidays and my SO’s income decreasing due to work layoffs. We are also approaching credit cards with balances over $1,000. With these high balances, we anticipate that it is going to take longer to pay off as our debt snowball payment is still below half that amount. Even with these odds against us, our hope still remains to diligent work on increasing our income and finding ways to cut expenses to help speed up this debt repayment process.

By the end of November, we were able to pay off a total of $565.01 in debt. This amount is about double of what we were able to utilize for our debt repayment in October. We are excited about the progress we are making towards our debt repayment, but still, have a long road ahead of us. We continue to look forward to making more progress toward our debt as we get creative with extra income and saving more.

Savings

October Total Savings: $5709.57

November Total Savings: $6096.22

Emergency Fund: $3755.90

Christmas Sinking Fund: $500.00

C’s Retirement Fund: $1840.32

As we mentioned back in our August Financial Progress report we saw a decrease in our savings but overall ended with a surplus in our maternity leave. That surplus in the maternity leave sinking fund was moved back to our emergency fund in September. We then intended to set up different sinking funds, to provide savings for specific items and to help us cash flow goals more effectively.

In October we managed to set up our Christmas Sinking Fund. We have been super excited about this accomplishment as this will be the first time in our relationship that we will cash flow Christmas. In previous years we have relied heavily on credit cards to fund Secret Santa gifts, Holiday Party Dishes, Santa Gifts and much more. We have set aside $100 for each person in our household. Additionally, we have budgeted $100 to use for work and family secret Santa activities and holiday dishes to pass. Do you have a Christmas Sinking Fund? What is the lowest budget you have been able to manage in cash flowing Christmas?

Overall, you may have noticed that our Savings has grown in November. We are excited to see this growth and even with our Christmas Sinking Fund, we are still on track to continue growing our savings.

Expenses

Total Expenses: Largest Spending Categories

Debt: 22%

Housing and Utilities: 18%

Food: 19%

SO’s Lifestyle: 10%

November served to be another interesting month in our category percentages. We had some expense categories shift due to changes in our spending needs. If you haven’t noticed, we started reporting on our housing and utilities together again last month. We decided that this was necessary as they are both needs for our home. With this change, we see our food spending move into second highest expense and a new fourth place expense is my SO’s lifestyle expenses. His expenses include his spending money and hobbies which is mainly composed of fishing!

We appeared to see an overall increase across many of our expense categories in November. Since we increased our budget to compensate for paying off our smallest credit card debt, we saw an increase in our debt expense percentage. Additionally, our cable bill changed their billing cycle requiring us to make two payments within a 30 day period. Also, our food budget increased slightly due to an increase in eating out but also shopping for Holiday potlucks. While we saw these increases, we were still able to make great progress in our debt repayment and savings growth.

As we move forward into December, we expect to see our expense categories decrease as we will have less total Income coming in. Stay tuned to learn more about how we manage our expenses in December.

Income

October Total Extra Income: $484.97

November Total Extra Income: $358.19

Yet again, we saw a decrease in our total extra income for November. Majority of our extra income in November came from an early Christmas bonus from my SOs employer. However, there was not as much time to pursue additional income opportunities. Nonetheless, we still made some slight progress in extra income in November. We contribute our extra income to our participation with Usertesting.com and our Ibotta.

My earnings through Ibotta increased slightly in November compared to October! Ibotta has been a great way for our family to receive cash back on our everyday grocery shopping. We have already earned over a $200 since we started using Ibotta a few months ago. Are you interested in learning how you can maximize your Ibotta’s earning potential? If you decide to start taking advantage of cash back through Ibotta, we invite you to join our team here. By joining our team and redeeming one offer within the first month, you will earn $10.00!

If you are looking for other small ways to increase your income, we recommend Swagbucks. Swagbucks is a great way to earn money through surveys, shopping online and trying out recommended products. If you join Swagbucks, please use my code to begin earning right away and you can earn free money!

Ibotta: $16.65

Mystery Shopping: $0.00

User testing: $40.00

Online Surveys: $1.53

Misc: $300.00

Monthly Goals

Back in July, we started sharing our monthly goals. This was done to create a visual of our goals as well as to hold ourselves accountable. We try to aim for at least 5 different goals that range within financial, personal, physical and life goals. Currently, we have been posting these goals to our Instagram. In August, we began highlighting our monthly goals and their end results in each financial progress report.

We decided to do this because many of the goals are small actionable goals that are contributing to our bigger goals of financial freedom. In our monthly goal visual, you will find a green checkmark on those we completed 100% and red cross marks on those we did not complete below 99%.

In November, we only failed to complete one out of the five goals we had originally set out to achieve for the month. If you are familiar with any of our past monthly goals, then you may not that we changed our goal focus slightly in November. We are excited that we managed to finally payoff D’s Citi Credit Card which was such a great relief. Time spent every day on self-development continued to be achieved and was heightened by completing the 30 days of Thanksgiving challenge. Additionally, we decided to lower our savings goals as we were struggling to meet our previous goal. This has proved to be successful for us in November as we were able to both pay off a small credit card balance and increase our savings contribution.

We love the focus and motivation that setting goals have brought to us. The amount of progress we have made by shifting the focus of our goals in November has been impressive.

We have really enjoyed using this process to commit to monthly goals. It aids in keeping us on track and allows us to break down those big dreams into smaller achievable ones. We look forward to continuing to do this each month. Check out our Instagram feed if you’re interested to see where our focus is going in November!

Recap

November happened to be a good month for most areas of our financial progress. We accomplished the ability to continue decreasing our debt, increase our savings and earn extra income. We contribute much of this success to our diligence in planning ahead in the previous months. While we are still learning the art of budgeting, we are still managing to move forward in the right direction.

Previous Financial Progress Reports:

- October 2018 Financial Progress Report

- September 2018 Financial Progress Report

- August 2018 Financial Progress Report

- July 2018 Financial Progress Report

- June 2018 Financial Progress Report

- May 2018 Financial Progress Report

- April 2018 Financial Progress Report

Overall, we achieved great progress towards Financial Freedom in November. We contribute much of our success to the support we gain from the debt-free community and having these reports for accountability. This has really allowed us to remain determined and confident in our abilities to keep meeting goals. December will be a month of surprises as we navigate changes in our income and how that will impact our budget into the New Year. Altogether, we look forward to our continued progress towards Financial Freedom.

How was your progress towards financial freedom in November? What was one thing that you were grateful for with your finances? Comment below to share your responses. We are a judge-free zone!